The impact of digitalization on banking is obvious: many financial transactions are done via smartphone, and there is rarely a need to visit a physical branch.

But what makes life easier for clients also has its drawbacks: The lack of direct interaction limits the ability to provide personalized, in-depth advice and build trust in the financial products offered. How can banks build lasting trust in the digital environment?

VR personalizes digital banking

Digitalizing banking and finance does not necessarily mean losing personal contact. Virtual reality bridges the gap between two worlds and enables a new, immersive, and interactive banking experience: Digital banking brings customers and financial professionals closer together.

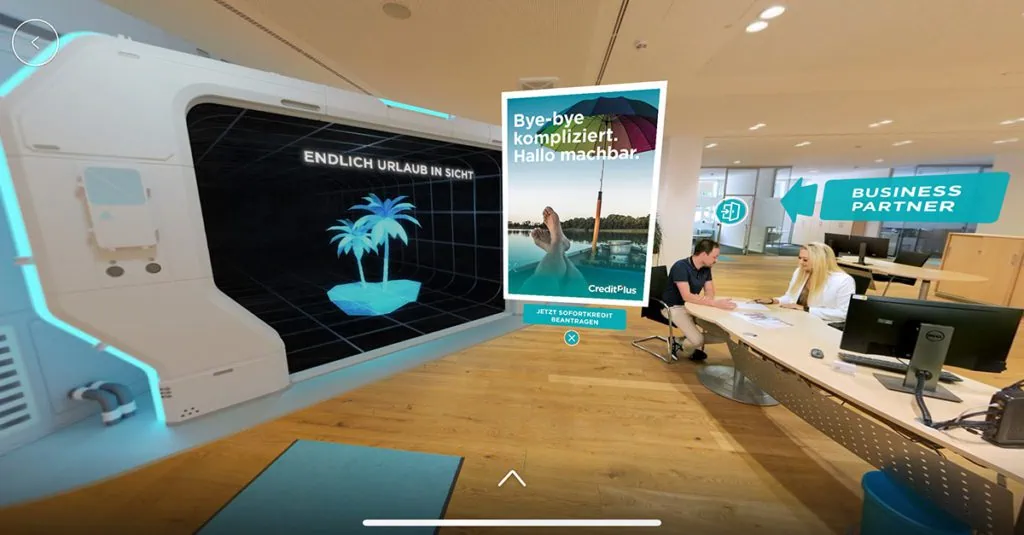

Creditplus Bank, for example, invites customers to a virtual yet customer-oriented consultation in VR. In the virtual branch, visitors and customers get to know the bank personally, despite the digital environment: They are greeted at the entrance and introduced to the bank by staff, then walk around the premises and talk to staff about the bank’s services and products.

The virtual branch also has a positive side effect: VR reduces the fear of entering a branch. This is particularly beneficial for people who are shy or have mobility issues that prevent them from visiting a branch. VR makes a bank’s advisory services more accessible.

VR expands the range of advisory services in finance

As a versatile technology, VR replicates existing advisory services in a 360-degree environment as video or images, completely transforming the offering. The immersive and interactive environment in VR allows for a much more personal banking experience than a website and is not dependent on opening hours.

The focus is always on customer value, such as a detailed VR tour of a simulated real estate property. Suitable financing and insurance options can also be presented in three-dimensional visualizations.

VR boosts interest, attention, and customer loyalty

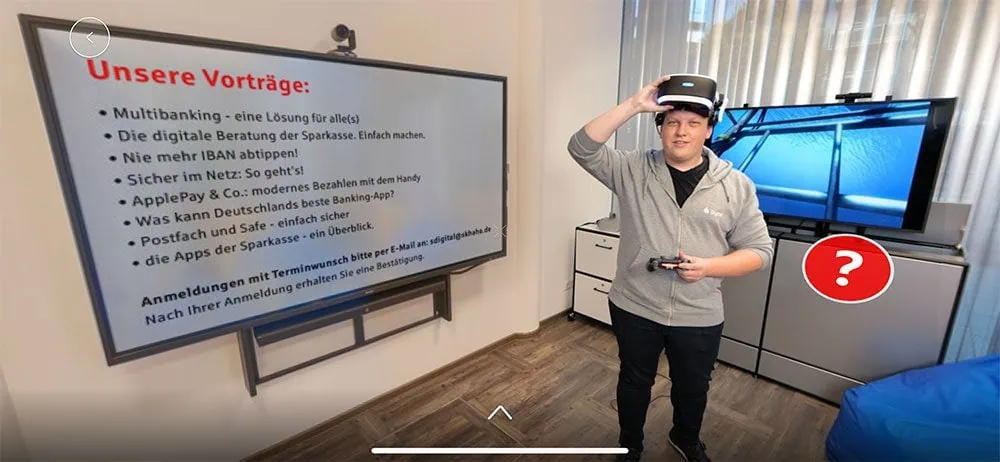

Personalized digital banking with VR also shows customers the innovative spirit of their bank. Sparkasse HagenHerdecke, for instance, has expanded its marketing to include VR and presents its digitalized offering in an eye-catching, personalized, and interactive way.

By offering VR services, banks can reach younger and particularly more tech-savvy audiences.

VR is an ideal way to get teenagers and young adults interested in financial topics in an innovative way or to recruit them as trainees. In addition, the personal experience and advice helps to build trust in the financial products offered.

These are just a few of the advantages that VR brings to finance:

- Banks can visually demonstrate the benefits of a home loan and savings contract while the customer takes a VR tour of their dream home. This creates a much better emotional connection than photos or 2D videos.

- Financial institutions can demonstrate the compound interest of a fund or ETF in a three-dimensional simulation of how the money grows. Not only does this help people understand, but the information stays with them longer.

- Insurance brokers can use simulated everyday scenarios, such as a burst water pipe or accidental property damage caused by playing children, to demonstrate the benefits of insurance policies such as household or liability insurance.

Banks, financial institutions, and insurance companies can also use VR to provide effective information and advice on sustainability issues, for example when building a house or apartment. The power of persuasion is enormous because of the immediate visual experience: simulating the environmental impact of purchasing decisions or the positive effects of sustainable financial products takes on a completely different, lasting effect when presented in a realistic VR application.

Getting started with VR is …

flexible

scalable

easy

Whether it’s a classic company presentation, in-depth financial advice or an enhanced sales experience, VR allows you to better understand and enhance individual customer needs through immersive experiences. The result is tailored and unique advice that meets the customer’s needs.

A key advantage of VR experiences is the flexibility of the content and its virtually infinite scalability. They unfold their full effect through the use of VR headsets.

The VRdirect platform also enables access from the couch at home, in-store or on the go via desktop, smartphone or tablet. This makes VR experiences accessible to all ages, regardless of their technical equipment.

VRdirect: Create virtual value with us

VRdirect supports banks, financial institutions and insurance companies on their strategic journey into the metaverse. Education, training, marketing and more: as VR professionals, we have successfully implemented numerous projects with banks and companies over the past few years.

To get started with Virtual Reality, we offer a no-obligation initial consultation. We will be happy to send you a pair of state-of-the-art VR headsets free of charge, including demos. Or you can visit our showroom and make an appointment with us!