Virtual & close to the customer: With VR, Creditplus unites digital & real

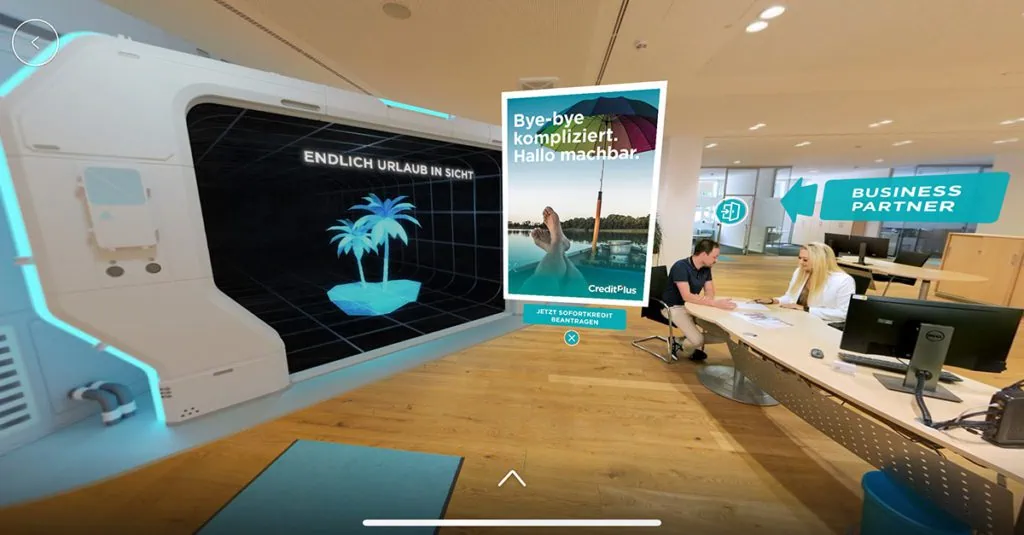

- Creditplus offers a virtual 360-degree tour of a digital showroom.

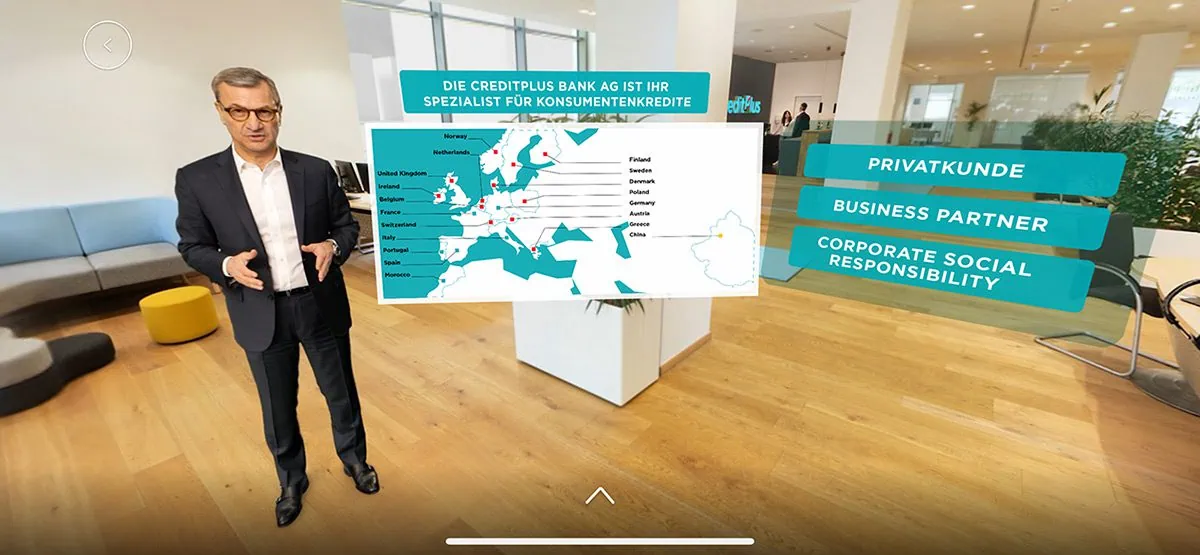

- Guests are personally greeted by the bank's management and can find out a wide range of information about Creditplus.

- In the interactive presentation, they select the topics that interest them personally.

- VR thus creates a personal experience at a distance that perfectly prepares for the on-site visit.

100% digital - and still close to customers and partners!

Trust is the most important currency for insurance companies, financial service providers and banks. Only when customers and business partners feel they are being well advised will they invest their money or take out a loan. An essential factor in building trust is customer proximity.

But how does a bank build proximity to customers and partners when banking is becoming increasingly digital and personal contact is becoming rarer? Creditplus, a specialist in consumer finance, was looking for a way to overcome the apparent contradiction between personal proximity and complete digitization.

To do so, Creditplus needed an experienced technology partner that could keep up with its own pace of innovation. The bank tested the market as part of a startup competition. VRdirect convinced with a Virtual Reality concept for a customer-oriented, interactive and personal company presentation.

How does Virtual Reality help banks and financial service providers?

In VR, people can experience places and people directly, regardless of their own position, without physically being there. Whether with VR headsets or via 360-degree video on a website and video platforms: The self-selected viewing angle, the free interaction with the environment and the personal presentation create proximity.

If you encounter a digital person with VR glasses, they appear life-size and thus much more realistic than in conventional videos. The dimensions of places also match reality. An experience that stays in the memory.

Creditplus uses this on-site effect for customer loyalty: Visitors inside get to know the bank in a virtual tour. In the digital showroom, they are welcomed personally before the bank’s management presents the services, products and philosophy of Creditplus to private customers and business partners.

VR at Creditplus: These are the advantages

Digital proximity to customers and partners:

The bank's management addresses (potential) customers and business partners directly and personally in VR.

Interaction:

During the virtual tour, visitors choose what they would like to find out about personally.

Experience information:

The bank's management explains the services and products in personal contact - almost like on-site. Everything already feels familiar during subsequent personal contact.

Visit the bank 24/7:

The virtual company presentation is available at any time on smartphone, tablet, PC and for VR glasses.

Living innovation:

Creditplus is launching a future-oriented service offering that focuses on personal proximity to customers and business partners.

With VRdirect, Creditplus is actively shaping the bank's digital future

The aim of the virtual company presentation is to make Creditplus a tangible experience for customers and partners from the very first second, say Jana Rau and Stephan Baumann, Head of Strategic Product and Innovation Management. The virtual showroom feels and sounds just like an on-site bank, and employees address potential customers personally.

VRdirect has successfully taken Creditplus’ philosophy of putting proximity to its customers and partners at the center of all its endeavors into the next era of digitization with VR. The VR experts have been managing large and small Virtual Reality projects in many companies for years, and their enterprise platform makes it quick and easy to get started with VR.

Find out now about the benefits and possible applications of Virtual Reality in the enterprise, or take a look at other projects in the showroom and arrange a no-obligation meeting.